At Mindful Trader, every trade I make in my own account is a trade that I post for subscribers to see. I trade options in my account, so if you sign up for this service you'll have access to see all my options picks.

My options trades are based on years of statistical research I did. Specifically the options picks I make are derived from my back-tested stock trading strategy. I don't trade based on gut instinct and I don't shoot from the hip. All my trading is rules-based so that I can match the back-tested approach as closely as possible.

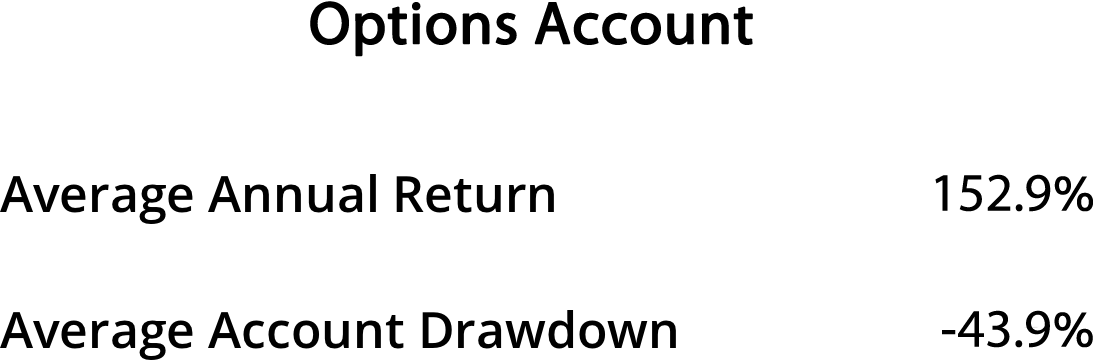

Here is a breakdown of how my options trading strategy performed over the last 20 years in back tests (using my preferred position sizing):

When I say I did a "back test", it means that I took my trading strategies and applied them against historical stock market activity to see how the trades could have performed. The results shown above are not my live trading results; they are the results of the back tests. These results certainly do not guarantee future results. See my disclaimer here.

You can see from the back test results that there is a lot of potential for account growth with these options picks, but there is also a lot of risk involved. Drawdowns of that magnitude are serious stuff. It isn't a free ride to triple-digit gains. You can lower the risk by lowering your position size.

This video talks more about my options picking service:

Here is a graphic that depicts what makes options trades exciting to me:

This image depicts a sample stock and how the price of both an option and a stock change when the stock price changes. There are a couple of key points I want to make about this chart:

1) If the stock price goes way up, there is the potential for me to get a much higher return with an option than I could with a stock. In many cases options offer two to three times as much profit for a standard profit target.

2) There is a fixed risk exposure for options. It doesn't matter if the stock price gaps way down due to bad news or a market crash or whatever -- your only risk is the premium you paid.

It's also worth noting that I typically buy options that are about a week from expiration (when options are at their lowest prices). If you are looking for option trades that have expirations that are further out, you can consider the options service at Stock Market Guides.

I set a profit target up front for my option trades. I also specify a time limit up front for each trade I take.

I risk about 5% of my account value for each options trade. If you want to risk more, that is certainly your call. Risking 5% matches my risk profile well, but if you have a bigger appetite for risk and reward, you of course can size your positions whatever way you want.

If you're an experienced options trader, I think you'll find my options picks to be very straightforward. If you are new to options trading and want to learn, I provide a lot of tutorials to help you get up to speed and to learn how to trade my options picks. I also teach the exact options strategy itself in case you want to learn more in depth about how I'm coming up with these picks.